Relocating to Malaysia for your studies is a significant event that requires adjusting to many aspects of daily life. One of the most crucial steps is opening a local Malaysian bank account. This guide will walk you through the practical steps needed to open a student bank account In Malaysia, including the required documents and essential tips. We’ll also cover the best banks and electronic wallets to make your life easier in this beautiful country.

The Importance of Opening a Student Bank Account for Foreigners In Malaysia

Opening a student bank account in Malaysia provides numerous benefits that make life easier and safer for international students and other foreigners.

- First, having a local bank account simplifies paying rent, buying daily necessities, and settling tuition fees without complications.

- Second, keeping money in a bank account is safer than carrying cash, reducing the risk of theft or loss.

- Third, a bank account helps track expenses and organize finances, enabling students to budget effectively and save for the future.

What Do You Need to Open a Student Bank Account In Malaysia?

As any student in Malaysia, foreign students can apply for a student bank account at almost all Malaysian banks, but specific documents and conditions are required. These requirements typically include:

- Passport.

- Valid Student Visa.

- Acceptance or Enrollment Letter From a recognized university in Malaysia.

- Proof of Local Residence.

- Initial Deposit (it may differ from bank to another).

Types of Bank Accounts Available for Students In Malaysia

There are several types of bank accounts that foreign and local students can open in Malaysia:

1. Savings Account:

- Ideal for students who want to save money securely with easy access.

- Basic features include ATM deposits and withdrawals, fund transfers, and online bill payments.

2. Current Account:

- Offers additional features like checkbooks and advanced banking services.

- Suitable for those needing frequent transactions.

- Allows the use of checkbooks and offers higher interest rates than savings accounts.

3. Fixed Deposit Account:

- Helps in saving for a longer period with higher interest rates.

- Suitable for students who want to save money over a long term.

4. Islamic Accounts:

Islamic accounts follow the principles of Islamic law. Some of the most important Islamic banks in Malaysia include Bank Islam, Bank Muamalat, and Al Rajhi Bank.

Opening a Student Bank Account in Malaysia (Step By Step)

Opening a bank account in Malaysia for Uni students involves a few straightforward steps. Here is a detailed guide to help you through the process.

1. Choosing the Right Bank

Select a bank that offers services suitable for your needs as a foreign student. Ensure the bank has branches and ATMs near your residence. Recommended banks include:

- Maybank

- CIMB Bank

- Public Bank

- RHB Bank

- HSBC

2. Preparing the Necessary Documents

Having the right documents ready makes the process smooth. Here’s what you typically need:

- Passport: Ensure it’s valid for at least six months beyond the account opening date.

- Two Forms of Identification: This can include your birth certificate or national ID.

- Valid Student Visa: Confirms your legal status.

- Acceptance or Enrollment Letter: An admission or registration letter from the university proving that you are a registered student at a recognized university in Malaysia.

- Proof of Local Residence: Such as a rental agreement or utility bill.

- Initial Deposit: Varies by bank.

3. Visiting the Bank Branch

With documents in hand, visit the chosen bank branch:

- Schedule an Appointment online to avoid long waits.

- Head to the nearest branch of your chosen bank.

- Bring All Documents and keep them organized in a file for easy access.

4. Filling Out the Required Forms

At the bank, you will need to fill out several forms accurately:

- Account Opening Form: Contains personal information and account details.

- Additional Forms: Depending on the account type and services required.

5. Receiving Your Debit Card

After opening the account, you will receive a debit card for ATM and store transactions. Make sure to activate it for online use before leaving.

6. Activating Online Banking Services

Ask the bank staff to help you activate online and mobile banking services. These platforms allow you to manage your finances conveniently. Try to check the money withdrawal limit and ask the bank employee to adjust it if it is too low.

Important Notes

To avoid any delays or issues, follow these tips:

- Ensure Validity: All documents, especially passports and visas, must be valid.

- Organize Documents: Keep them in a file for easy access.

- Make Copies: Keep additional copies of all documents in a safe place.

- Verify Your Residence Address: Ensure it is current and accurate and bring a proof (a water bill for example).

- Check Bank Requirements: Visit the bank’s website or call to confirm specific requirements before visiting them.

- Request University Documents Early: Contact your university international student office in advance to get your documents ready.

- Original documents: All submitted documents must be originals, photocopies are not accepted.

- Matching information: The names on all official documents must be exactly the same as what is written on the passport/visa documents.

- Language requirements: Depending on the bank’s policies, there may also be English language proficiency requirements for applicants who do not have Malay language skills.

The identity verification process usually takes about two weeks for non-students, while the process is faster for students and this timeframe varies depending on each bank’s practices and procedures. Once satisfactory proofs are submitted and approved, foreign students in Malaysia can open their own accounts with ease.

Challenges You May Face and How to Overcome Them

Opening a bank account in Malaysia might present some challenges. Here’s how to tackle them:

1. Varying Requirements: Different banks may have different requirements, causing confusion. To manage this:

- Check Requirements: Look up each bank’s requirements online or call customer service.

- Prepare All Documents: Have all possible documents ready and valid.

- Contact Banks Directly: Ask for any additional required documents.

2. Language and Cultural Barriers

This is not a problem in main Malaysian cities, but communication can be difficult due to language and cultural differences in marginal areas. Here’s what to do:

- Bring a Friend who speaks the local language.

- Use Translation Apps for immediate assistance.

- Learn Basic Phrases in the local language.

3. Delays in Document Issuance

Documents like university acceptance letters or proof of residence might take time to get. To avoid delays:

- Request Early: Apply for these documents well in advance.

- Stay in Touch: Keep regular contact with the issuing office.

4. Issues with Address Proof

Some banks might have strict requirements for proof of address. To manage this:

- Ask for Alternatives if other documents are acceptable.

- Confirm Requirements before visiting the bank.

5. Account Opening Delays

Administrative processes might delay account opening. To deal with this:

- Understand that these processes can take time.

- Regularly check the status of your application.

Best Banks in Malaysia for Foreign Students

Choosing the right bank ensures your comfort later on. Here is a comparison of some well-known banks in Malaysia, highlighting their pros and cons, and the services they offer to students and foreigners.

1. Maybank

Maybank, Malaysia’s largest bank, offers a comprehensive range of financial services, including retail banking, investment banking, and insurance.

Pricing:

- Maybank’s account maintenance fees vary by account type, but they tend to have higher fees for premium accounts.

- Students and basic savings accounts typically have lower fees or are fee-free.

Pros:

- Extensive Network: Maybank has the largest branch and ATM network in Malaysia, making it highly accessible.

- Variety of Services: They offer a wide range of accounts, including savings, current, and multi-currency accounts, alongside extensive online and mobile banking services.

- Foreign Student Friendly: Maybank sometimes waives the local address proof requirement, which can be a significant advantage for newcomers.

Cons:

- Higher Administrative Fees: Certain account types, particularly premium and special services accounts, can have higher administrative fees.

2. CIMB Bank

CIMB Bank is one of the leading universal banks in Southeast Asia, providing services in consumer banking, investment banking, and asset management.

Pricing:

- CIMB’s fee structure is competitive, with some accounts offering zero fees for basic transactions.

- Their multi-currency accounts can incur additional charges depending on the currency and transaction type.

Pros:

- Advanced Services: CIMB offers advanced banking services such as multi-currency accounts, which can be beneficial for international students dealing with multiple currencies.

- Extensive Network: With numerous branches and ATMs, CIMB is widely accessible.

- Specialized Accounts: CIMB provides accounts tailored to foreigners with added benefits like lower remittance fees.

Cons:

- Complex Procedures: Account opening and other administrative processes can be more complicated and time-consuming compared to other banks.

3. Public Bank

Public Bank focuses on retail and commercial banking, offering a broad spectrum of financial products and services.

Pricing:

- Public Bank has a competitive fee structure, especially for basic savings and current accounts.

- They offer student accounts with minimal fees.

Pros:

- Reputation for Trust: Known for its stability and trustworthiness, Public Bank is a safe choice.

- Comprehensive Services: They offer a wide range of banking services, including loans, credit cards, and wealth management.

- Easy Account Opening: The process for opening an account is straightforward, even for foreigners.

Cons:

- Less Flexibility: Public Bank can be less flexible with certain requirements, which might be a hurdle for some foreign students.

4. RHB Bank

RHB Bank provides a range of financial services, including retail and commercial banking, investment banking, and Islamic banking.

Pricing:

- RHB’s fees are generally reasonable, with student accounts often benefiting from reduced or zero fees.

- Their Islamic banking products cater specifically to students and individuals looking for Shariah-compliant options.

Pros:

- Variety of Accounts: RHB offers a broad array of accounts, including conventional and Islamic banking options.

- Special Programs: They have specific programs designed for students and foreigners, making the banking experience more tailored.

Cons:

- Fewer Branches: Compared to Maybank and CIMB, RHB has a smaller branch and ATM network, which might be less convenient for some students.

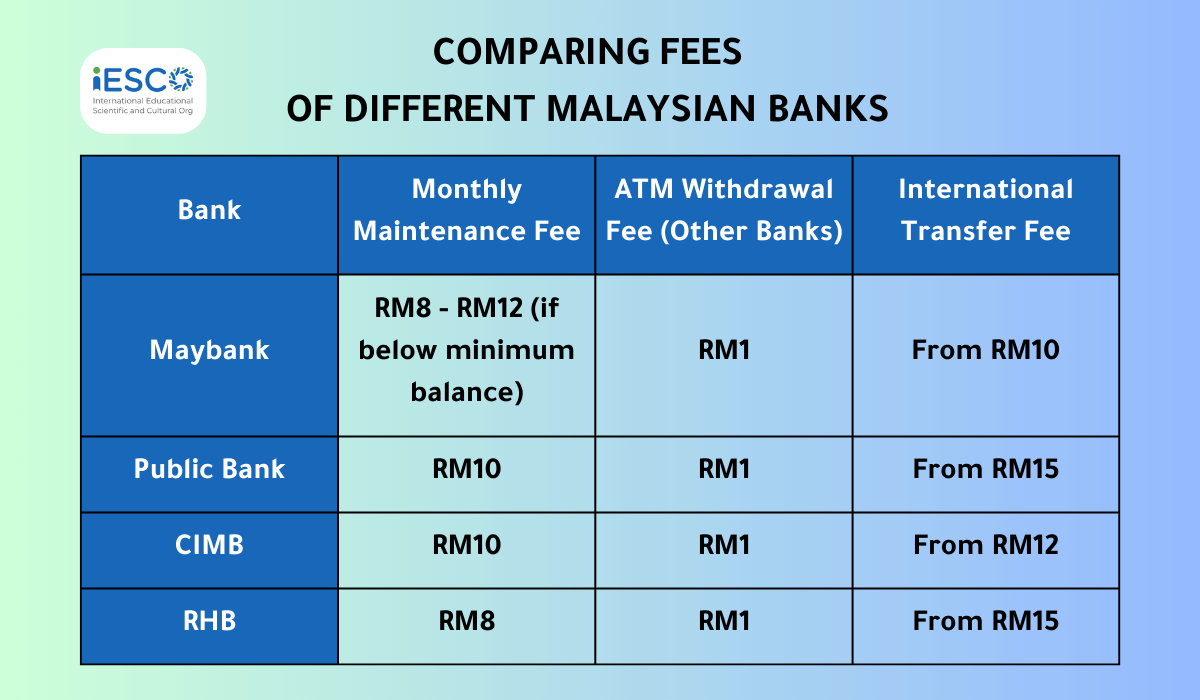

Overview of Bank Fees in Malaysia

Understanding the fees associated with opening and maintaining a bank account in Malaysia is essential. Here’s a brief overview:

- No Account Opening Fees for most banks.

- Monthly Maintenance Fees applied if the balance is below a certain limit.

- ATM Withdrawal Fees charged for using other banks’ ATMs.

- International Transfer Fees that vary by bank and amount.

- Annual Card Fee for debit and credit cards.

- Dormancy Fees for inactive accounts.

Here are tips to avoid or minimize bank charges in Malaysia

- Choose an account that suits your personal or business needs and look at the associated fees before opening it.

- Avoid monthly fees by maintaining the required minimum balance.

- Use your bank’s ATMs to avoid withdrawal fees.

- Use e-banking to transfer funds and manage your account to avoid some fees.

- Review your statement regularly to check for unnecessary fees.

To find the right bank, we offer you a comparison of the fee structure between different banks:

Comparing Fee of different Malaysian banks

Recommended Digital Wallets in Malaysia

Digital wallets are widely used in Malaysia for digital payments. They offer convenience and speed for daily transactions. Here are some top e-wallets:

1. Boost

One of the most popular e-wallets in Malaysia, Boost provides a seamless and easy-to-use digital payment experience:

- Easy top-up via bank accounts and credit cards.

- Exclusive offers and discounts.

- QR code payments at various stores.

2. GrabPay

An e-wallet from Grab, a multi-service company that includes transportation and delivery:

- Used for Grab services like transport and food delivery.

- Rewards system for earning points.

- QR code payments at multiple outlets.

3. Touch ‘n Go eWallet

A popular e-wallet that is widely used in Malaysia’s transportation system:

- Used extensively in transportation and highways.

- Supports online purchases.

- Offers special discounts.

4. MAE by Maybank

An e-wallet that is integrated with MyBank’s banking services and has a few advantages:

- Integrated with Maybank banking services.

- Tools for personal finance management.

- Instant fund transfers between accounts.

Frequently Asked Questions

In this section, we provide answers to some common questions about banking in Malaysia, helping you understand the procedures, requirements, and options available to you.

Can I open a bank account in Malaysia before arriving?

Yes, it’s possible, especially with international banks having a presence in Malaysia. You might need a pre-existing relationship with the bank and a local contact as a reference.

Can I Open A Student Bank Account Online In Malaysia?

Yes, you can open a student bank account online in Malaysia. Banks like CIMB, Maybank, and Bank Islam offer fully online account opening processes that are straightforward and convenient.

To open a student bank account online, you’ll need to follow these steps:

- Choose a Bank: Some of the popular options include CIMB, Maybank, and Bank Islam. Each bank offers different perks and services tailored to students.

- Gather Required Documents: Typically, you’ll need your MyKad (Malaysian identity card) or passport, proof of enrollment from your university, and a bank reference letter from your university.

- Visit the Bank’s Website: For example, CIMB allows you to fill out an online application form, verify your identity through a selfie and MyKad scan, and make an initial deposit via an FPX transfer from another bank account. Similarly, Maybank and Bank Islam provide similar online procedures.

- Complete the Application: Fill out the online forms, upload the necessary documents, and submit your application. Some banks might require a video call for identity verification.

- Receive Your Debit Card: Once your application is approved, the bank will send your debit card to your registered address. You can then activate it online and start using it.

This process ensures that you can manage your finances easily without needing to visit a physical branch, making it ideal for busy students.

Are there limits on international money transfers?

Yes, banks usually set limits on international transfers. These limits and associated fees vary by bank. Check with your bank for specific details.

Can I apply for a Malaysian credit card as an international student?

It’s challenging but possible. Eligibility depends on your visa type, income level, and whether you have a local guarantor. Some banks may require a higher deposit as collateral.

What digital banking services are available for international students in Malaysia?

Most Malaysian banks offer comprehensive digital banking services, including mobile apps and online platforms for account management, fund transfers, bill payments, and balance checks.

How do Islamic accounts differ from other accounts?

Profits generated by the project are divided between the two parties according to a pre-agreed percentage, while losses are borne by the owner of the capital only, unless the losses are due to the negligence or mismanagement of the speculator.

- Islamic accounts are also based on the principles of wadiah, which means depositing funds with another party with the obligation of the party holding the funds to safeguard them and return them upon request. In the Islamic banking context, deposits are made on the basis of a deposit or trust contract, where the bank is responsible for safekeeping and investing the funds in a safe and profitable manner, without assuming the risks associated with their investment. The bank is entitled to a fee for safekeeping the funds, but this fee must be fixed and not dependent on investment results.

- These accounts allow you to earn dividends instead of interest.

Do Malaysian banks offer scholarships or special programs for students?

Yes, many banks offer special programs for students, which may include lower fees, special savings accounts, scholarships, educational loans, and financial advice services.